Bloomberg, citing anonymous sources, reported that US oil giant Exxon Mobil Corp plans to sell its petrol stations in Singapore. The deal could generate about $1 billion.

According to the report, a sale would enable Exxon’s to invest the cash in other segments of the business with greater growth prospects.

The report noted that investors and players from the energy sector had shown interest in purchasing the assets.

According to Esso, Exxon operates 59 petrol pumps in Singapore under the Esso brand.

Second big divestment in recent months

The sale would be the second divestment by the oil giant in Southeast Asia within the last few months.

Reuters reported that Exxon agreed in July to sell its Malaysian assets to the state-owned energy company Petronas. This would see Exxon exit the upstream sector of Malaysia, where it was once a dominant player.

The company has operated in Singapore for over 130 years.

The company operates a refinery complex in the country as well as a lubricant factory, a fuels station and a liquefied gas bottling facility.

This sale may also be a reflection of similar efforts by other oil giants, such as Chevron Corporation.

Bloomberg reported that Chevron Corp is considering selling all its Caltex service stations in Hong Kong due to interest from potential investors.

Guyana’s shallow-water block

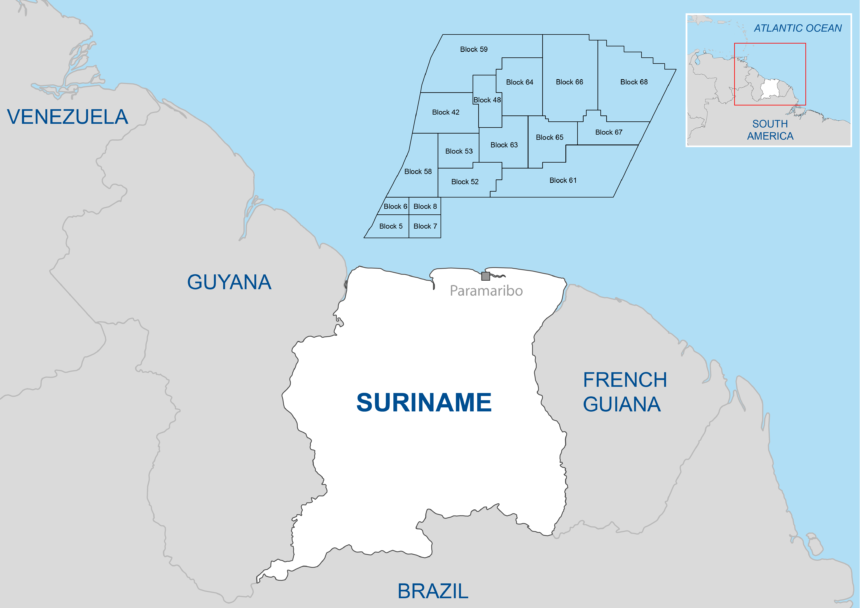

Reuters reported that Exxon Mobil, its partners in Guyana (US Hess Corp. and China’s CNOOC) and the local government have been discussing the development of a shallow water block.

The block was purchased at an auction in the year 2022.

Exxon, along with its partners, has been pumping crude oil from Guyana at a rate of more than 600 000 barrels per day. Production is concentrated on one offshore block called the Stabroek Block.

According to the report, the consortium is interested in developing an offshore shallow-water block.

Exxon, along with its partners in Stabroek, developed several oil-producing platforms.

Increased revenue from offshore block in Guyana

Exxon, along with its partners, has received revenues and profits worth billions of dollars since the discovery of offshore block in Guyana.

The block’s production has soared to a level of over 600,000 barrels a day.

According to the report, the company aims to increase production from the offshore block to more than 1 million barrels of oil per day.

The government wants to maximize the returns on the oil industry to avoid the peak in demand predicted for 2030.

The report says that if the predictions of peak demand fail to materialize then the outlook for Guyana’s oil industry will be even better.

The post Exxon to sell Singapore petrol stations for $1 billion in order to focus on high profit sectors may be updated as new developments unfold.