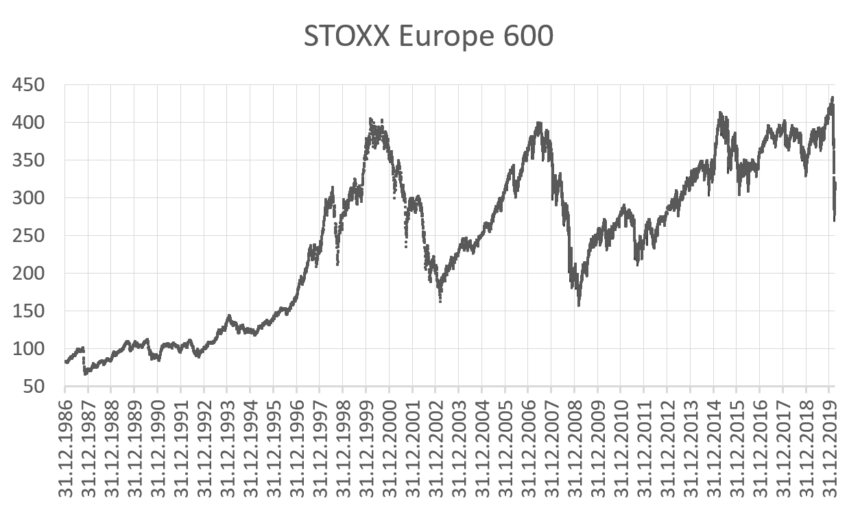

The STOXX 50 index rose 0.3%, while the STOXX 600 index gained 0.4%. This rebound came after a three-day losing run, as investors awaited the European Central Bank (ECB) monetary policies decision.

Traders are waiting for the ECB to announce its interest rate policy

The market is firmly focused on the ECB which is expected to maintain interest rates at their current level. Investors are closely watching for any indications of future rate reductions. The central bank’s announcement and decision are expected to have a significant impact on the market’s sentiment and trading strategies.

Sector Performance Highlights

The automotive sector led the market gains with notable increases in the shares of Mercedes-Benz (2.3%), BMW (2%), Volkswagen (1.8%), and Repsol (1.2%). The technology sector, on the other hand, continued to be under pressure. This was highlighted by declines at ASML Holding (0.9%), Siemens (-2.7%), and Schneider Electric (1.4%).

The energy sector also saw a rise of nearly 1% in response to higher crude prices. This helped the STOXX 600 end its three-session losing streak.

Mixed fortunes in earnings reports

The market has reacted in different ways to a series of earnings reports. Nokia suffered a major setback after reporting a loss of 32%. It fell more than 4%. Husqvarna also fell 13.1%, to the bottom of STOXX 600, after a 9% decline in sales for the second quarter. This was attributed to cautious spending by consumers.

Volvo, on the other hand, experienced a 5% rise due to higher-than-expected operating earnings, despite lowering its full-year forecast. Publicis soared 4.9% as the French advertising group upgraded their organic growth guidance and beat second-quarter expectations. Essity also advanced 4.1%, after the Swedish manufacturer of hygiene products reported earnings that exceeded expectations for the second quarter.

Expected impact on the Euro of ECB decision

The Euro could be affected by the ECB’s decision to maintain interest rates. If the ECB meets market expectations, then the Euro’s reaction could remain stable. Investors will be looking for dovish signs that indicate future rate cuts. This could weaken the Euro because of the usual currency-weakening effects of lower interest rates.

The overall market mood, influenced by ECB’s tone, and confidence in Eurozone’s economy, will play a key role in the Euro’s trajectory after the decision. Aside from deviations in market expectations, external factors like global economic conditions, trade dynamics and geopolitical development can also influence Euro movements.

The SSMI index fell 0.5%. ABB, which reported a slightly higher-than-expected profit for the second quarter, saw its shares fall by 5.3% as it published its final figures under departing chief executive Bjorn Rosengren.

Overall, the European market is a mix of optimism and caution. Investors closely follow the ECB’s policy decisions, while navigating a volatile environment of sectoral performances and earnings announcements. Investors continue to be attracted by the expectation of interest rate easing this year, which could set the stage for future market movement.

This post European markets rebound before ECB decision amid mixed results may be modified as new updates unfold

This site is for entertainment only. Click here to read more