Pierre Wunsch, head of the Belgian central bank, said that despite differing opinions between European Central Bank officials about interest rates and inflation, there was no urgent need to accelerate policy easing by the ECB.

The ECB is divided on the issue of caution.

The current economic situation in Europe does not justify a quick decrease of interest rates, according to Wunsch.

He points out the robust employment rate, increasing real wages and an expected mild economic slowdown, which suggest a more gradual adjustment of monetary policy.

The view of Mario Centeno, a Portuguese policymaker, is in contrast to other proposals, such as a possible 50 basis-point rate reduction at the next meeting, which will be held in December.

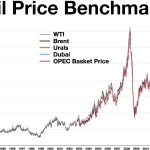

The ECB’s inflation forecasts

Wunsch admits that the inflation rate could reach the ECB target by 2025 but he minimizes the possibility of a decline in the long term below 2%.

He emphasizes the importance of distinguishing between fluctuations in short-term prices, which are often affected by energy price changes, and longer-term trends.

Wunsch calls for future rate reductions to be cautious and based on broader indicators of the economy, as well as waiting until existing limitations to economic growth have been lifted.

A balanced policy approach

Wunsch urges a balanced policy, which takes into consideration the fluctuation of prices for energy both up and down.

He argues the ECB must adopt a consistent stance in its inflation response to avoid short-term fluctuations of prices having a major impact on long-term decisions.

Market expectations are for a rate reduction of 35 basis points by the 12th December, with an increased chance that it could be as high as 50 basis points.

The ECB is currently facing a period of uncertainty, and the resulting fluctuations will affect its future policy decisions.

The remarks of Wunsch are crucial in the current discussion within the ECB on the best way to proceed in light of the changing economic conditions.

I would argue that the underlying data on inflation rather than just looking at headlines may be a better indicator of how restrictive policy really is,” Wunsch stated.

Wunsch warned that it was not a good idea to rush into December as the major economic events in the coming weeks and the data released will be of great importance.

What’s ahead?

Pierre Wunsch’s observations highlight the complexity of the situation as the ECB negotiates different opinions about interest rates, inflation and monetary policy.

Achieving a balance between economic stimulation and financial stability is a major challenge for policymakers.

In the months to come, the dynamic economy in Europe will continue influencing the ECB’s policy decisions. This requires a well-crafted and thoughtful approach.

The ECB’s chief cites the stability of its policy and says that no immediate policy easing is needed. This statement may change as new developments unfold

This site is for entertainment only. Click here to read more