Demand concerns continued to affect crude oil prices in the new trading week. The market still finds support from the Federal Reserve’s recent rate cut. Geopolitical tensions remain a positive for crude oil.

The focus of this week will be on the US economy and China. In addition, increased conflicts between Israel and Hezbollah could disrupt oil supplies which would in turn increase prices.

Chinese demand

Chinese demand

China, the world’s largest crude oil importer has continued to limit the price rise potential. Data released on Friday showed that the growth rate of the second-largest economy in terms of revenue between January and august had slowed by 2.6%.

The reading was the same as the previous month. In August, however, the figures dropped 2.8% YoY. It was a decline of 2.8% YoY, compared to the drop of 1.9% in July. The fiscal expenditure of the country increased by 1.5% from January to August, compared with the 2.5% increase between January and July.

Goldman Sachs lowered its growth forecast for this Asian country in mid-September from 4,9% to 4,7%. Despite the pressures of the economy, calls for more stimulus are increasing.

Investors are eagerly awaiting the remarks of PBOC Governor Pan Gongsheng at the press conference on Tuesday. The central bank has decided to lower its 14-day reverse purchase rate. The Chinese government’s efforts to boost the economy are likely to be a positive factor for crude prices.

Crude oil prices’ tailwinds

Crude oil prices’ tailwinds

The geopolitical tensions within the Middle East continue to support crude oil prices despite the concerns about demand. Oil prices are still relatively complacent despite the escalating conflict between Israel and Hezbollah. The reason for this is that the oil supply has not yet been disrupted. If Iran becomes involved, however, the status-quo is likely to change, pushing crude oil prices higher.

AccuWeather’s meteorologists also warned that a hurricane of major proportions is approaching the Gulf of Mexico. Shell has announced that it will halt production on two of its platforms near the Gulf of Mexico ahead of Hurricane Francine. The US weekly inventory decline that results could further increase oil prices.

What can you expect this week

What can you expect this week

Investors will be watching for additional clues about the Federal Reserve actions in addition to the PBOC’s press conference. The crude oil market will react to Friday’s inflation figures. The PCE Price Index, the Fed’s preferred inflation gauge, will reveal the level of price pressure.

These figures are released at a moment when the Bank has begun to relax its restrictive monetary policies. Analysts predict that the PCE core price index will have increased 2.6% on an annual basis in August. CB consumer sentiment, durable goods orders and the weekly crude inventory report will also be released during the week.

Investors will also be watching for remarks from various Fed officials, including the chair of the central bank. Jerome Powell will be speaking at the US Treasury Market Conference in Washington on Thursday. The public is eager to hear how Powell views the balance sheet reduction.

Brent crude oil forecast

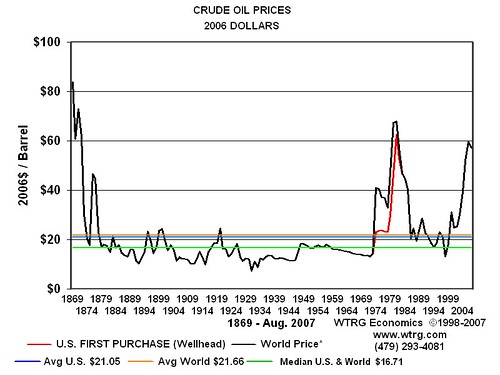

The chart for the daily shows that crude oil prices peaked earlier this year at $92, and then fell to a low price of $68.77 by September 10.

The 50-day and the 200-day moving averages crossed along the way to form a death-cross chart pattern.

Brent crude also fell below the important support levels at $76.77 – its lowest point since June 4th. Brent crude has recovered to around $74 after some investors purchased the dip.

Recent rebound is a temporary rebound after a strong asset has formed a rebound. This rebound is typically short-lived in most cases.

After the flash PMI manufacturing and services numbers were weak in the US and Europe there are indications that the demand is weak. The price is likely to resume its downward trend, as sellers aim for the next level at $68.77. This is approximately 7% below the current level.

This post Crude Oil Price Rebound Could Be Short-Lived: Technical Analysis may be Modified as Updates Develop

This site is for entertainment only. Click here to read more