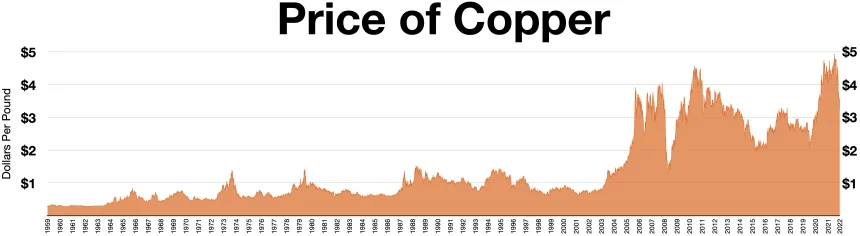

In response to the recent speech by President Xi Jinping following the CCP’s Third Plenum, copper futures fell to $4.3 per pound. This is a three-month high.

Xi’s speech, in which he did not make explicit reference to measures aimed at boosting domestic consumption, has sparked anxiety within China’s industrial sector. This base metal is a major consumer for the country.

Copper prices continue to fall despite a decrease in China’s NBS Manufacturing Purchasing Managers’ Index (PMI) over consecutive months.

The Chinese manufacturers and smelters have reoriented their efforts to boost exports due to the economic slowdown. This is evident by a stunning 187% increase in annual copper exports.

While inventories are rising, trade barriers continue to be a major concern

The potential for trade restrictions by the United States and Europe will cast a shadow on the global copper trade dynamics.

The Yangshan Premium is also near zero due to the burgeoning inventories of copper in Chinese warehouses, which highlights the current challenges facing the sector.

Market analysts are closely watching developments in China’s trade policies and industrial policies, anticipating the profound impact they will have on copper prices and broader base metal markets.

There is uncertainty over China’s upcoming stimulus initiatives and the potential impact they could have on copper demand. Concerns about prolonged stagnation of the economy in important sectors such as manufacturing, which is crucial for copper consumption, are growing after Xi’s recent speech.

According to data released on Wednesday, the Chinese refined copper output rose by around 4% from the previous month to 1,13 million tonnes, as a rise in the price of sulfuric acid, a by-product, helped to mitigate refining losses. The absence of clear signs promoting domestic demand raises concerns about a possible slowdown in the copper market.

In the face of these uncertainties, investors are cautious and wary about their impact on market stability and investment strategy.

China’s economic policy has a significant influence on global commodity markets. This highlights the interconnectedness of international borders and their potential effects.

Copper prices are uncertain as stakeholders wait for clearer economic instructions from China. They will also depend on the country’s economic strategy in the next few months.

The post Copper prices fall to 3-month low amid China industrial concerns may be updated as new information becomes available.

This site is for entertainment only. Click here to read more