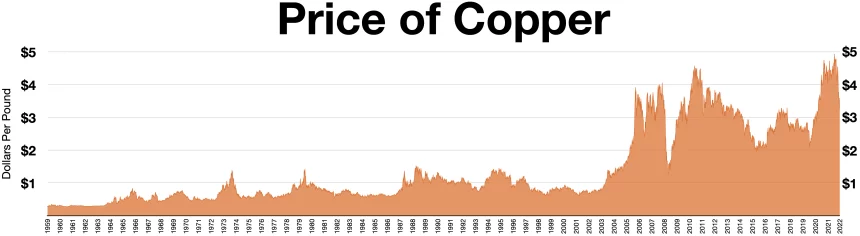

The London Metal Exchange (LME) has seen a drop in copper prices, which fell by 0.7% at 11:06 GMT to $9.045 per ton. This is an 18% decrease from the record high set in late May. It highlights the volatility of the metals markets.

The current drop in copper prices is part of a larger trend, influenced by an increase in inventories and a weak demand from the major consumers.

The LME copper inventories have risen dramatically, with the total amount of copper stockpiles more than doubling since early June to 239 100 tons.

This rapid increase in stocks highlights a significant surplus of supply. This trend was also reflected on the Shanghai Futures Exchange where inventories increased by tenfold in this year. However, they have recently fallen to a 2-month low of only 301,203 tonnes.

Copper prices are under pressure due to an excess supply, which is contributing to current market instabilities.

Copper remains an essential component for global energy transition despite its recent price decline. Its high conductivity, and the fact that it is used extensively in electrical cables, make copper a very important material.

State Grid Corporation of China (a major consumer of copper) has spent a record amount of 600 billion Yuan in this year. This investment highlights copper’s crucial role in the transition towards renewable energy and development of infrastructure, which could provide long-term support to copper prices.

Copper prices and central bank policies

The central bank’s policies heavily influence the market sentiment toward copper and other metals.

The metals market will be closely watching the interest rate talks from three central bankers this week.

Market expectations are shifting to a possible 25 basis point cut in September.

The Fed’s dovish remarks, softer US job data and cooling inflation are driving this shift.

A reduction in borrowing costs may stimulate manufacturing and increase metals demand.

Prices are affected by union actions in Chile

The copper price briefly recovered after news broke that the union of the Escondida mine, the world’s biggest copper mine, had urged its members to refuse a final contract offered by the company. This raised the possibility of a possible strike.

Labor disputes in major mining operations have the potential to disrupt supply chains, causing price fluctuations on the global market.

Other base metals also reported mixed results at the LME.

Zinc prices fell by 0.1% to $2666.5 per tonne, but lead prices rose 0.6%.

Nickel prices increased by 0.4%, to $15,860 a ton. Tin prices grew by 0.4%, to $29 695 per ton. Aluminum prices fell 1%, to $2,265 a ton.

The future direction of the copper price and the metals market as a whole will depend on several factors, including inventory levels, demand in key sectors like energy and manufacturing and macroeconomic conditions, such as central bank policies.

Copper prices could be supported by the energy transition, potential disruptions in supply due to labor disputes and current surpluses of inventory.

The following post Copper Prices Drop 0.7% amid Weak Chinese Demand and Rising Inventory may be updated as new developments unfold.

This site is for entertainment only. Click here to read more