Chainalysis’ Geography of Cryptocurrency report 2024 shows that Colombia is a key player in the region’s cryptocurrency market.

In the period, more than US$6.788billion was spent on Bitcoin in China.

Bitcoins’ value has increased by over $100,000 in the last few days, a significant milestone. This coincided with Donald Trump, newly-elected president, making a declaration on government policy.

The global market was impacted by this development, which increased the value of corporations that hold Bitcoin and raised the assets in countries such as El Salvador.

The effects of the increase are not limited to wealthy investors and established economies.

Experts in the industry believe that the soaring Bitcoin price, the more favorable laws of the US Government, and the possible establishment of a Bitcoin Strategic Reserve will help the cryptocurrency gain increased legitimacy and an increasing user base.

Colombian cryptocurrency adoption is on the rise

The Geography of Cryptocurrency Report by Chainalysis, however, indicates the adoption of digital activities within the region. Colombia ranks fifth among the countries in the area in terms of the number of people who have used cryptocurrencies. This is based on the US$28.455 millions that Colombia received from the second half of 2023 to the first half of 2024.

Even though Bitcoin has not yet surpassed remittances, this percentage is still greater than 50%.

Bitcoin, for example, may become more popular as a means of investment and transfer, especially if Trump is elected president.

Juanita Rodriguez Kattah is Bitso Colombia’s Country Manager. She says that the Bitcoin Record highlights the importance of understanding and studying the fundamentals behind cryptocurrency.

“The arrival of this historic price confirms the value and confidence in bitcoin that is being enhanced by businesses, institutions investors and governments all over the world.”

Adoption rates across Latin America

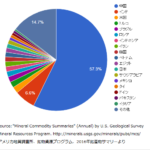

The adoption rate of Bitcoin in Colombia is currently 13.7%.

Comparatively, neighboring countries have varying levels of Bitcoin adoption: Brazil is at 14.2%, Argentina is 14.7% and Mexico has a notable 19.3%.

These rankings could change in future years, as attitudes towards Bitcoin and the legal frameworks may evolve.

Colombian cryptocurrency market is dominated by stablecoins

Stablecoins are a new addition to the cryptocurrency market in Mexico.

Stablecoins are responsible for 44.7 percent of global cryptocurrency transactions. Altcoins, at 24.6 percent, and Bitcoin, at 22.3%, follow.

Stablecoins are the dominant currency on the Colombian Market, with 66% of all transactions.

The highest level of stabilitycoins is in Colombia, with Argentina (61.8%), Brazil (59.8%) and Venezuela (56%).

Stablecoins’ financial impact in Colombia was US$3.178 Billion by June 2024. This shows the significance of stablecoins to the crypto-economy of the country.

The Colombian investor community is expressing a desire to secure their investments with digital assets linked to currencies.

Future of cryptocurrency in Colombia

Colombia has the chance to become a leader in Latin America in the adoption of stablecoins as it navigates through the new cryptocurrency landscape.

In Colombia, the combination of favorable regulatory environments and increasing consumer demand point to a bright future for cryptocurrency. People are adopting digital assets rapidly for investment purposes and for money remittance.

The overall development of Bitcoins and Cryptocurrencies in Colombia reflects broader trends poised to impact the financial and economic fabric in the region. This indicates a momentous transformation in which digital currency may be a key factor in financial futures.

The post Colombia is 4th in Latin America for Bitcoin revenue, with $6.79 Billion in 2024 could be updated as new information becomes available.

This site is for entertainment only. Click here to read more