Reuters reports that China, in a bid to escalate the trade war, has imposed strict export restrictions on metals vital to multiple industries including defense, renewable energy and other sectors.

Beijing’s announcement was made just minutes after US President Donald Trump imposed an additional 10% on Chinese imports. This marked a rapid and direct reaction from Beijing.

These restrictions will disrupt the global supply chain and may impact production in China as well as the US.

It could complicate an already difficult economic relationship between two superpowers.

It is likely that the affected industries will have difficulty sourcing alternate supplies. This could lead to higher costs and production delays.

China dominates the critical minerals space

Since 2023, China has used its position as the dominant player in the crucial mineral supply chain to exert geopolitical influence.

This ongoing strategy has seen the recent implementation of restrictions on exports for gallium and Germanium, in December.

Minerals are essential components for a variety of technology, such as consumer electronics, like mobile phones, batteries in electric vehicles, and military applications, like infrared guided missiles or conventional ammunition.

China has a near-monopoly in the production and mining of critical minerals, giving it a significant advantage over other countries.

China could exert pressure by controlling supply of essential materials on other nations, disrupting the supply chain and preventing technological progress in areas it considers strategic.

New metals banned

The Chinese government has announced immediate trade restrictions for tungsten and related metals, including tellurium bismuth indium molybdenum.

According to Reuters, these metals are used in a variety of products including artillery shells and solar panels.

The Chinese Commerce Ministry issued a press release shortly after US tariffs were imposed on Chinese imports. It stated that these controls had been implemented in order to “protect national security interests.”

It announced on January 16 that this year it will increase export controls.

Exports are likely to decrease, even though the controls don’t include an outright ban. This is because export permits, which take about six weeks to get, will be rushed by companies.

The report states that although shipments will recover gradually as new licenses are issued, it is to be expected given the results of past export restrictions.

US Uncertainty

Since 2015, the US relies on imported tungsten and imports of bismuth, after domestic mining and refinement operations for both metals ceased.

It’s not clear if US importers can obtain licenses to import these metals.

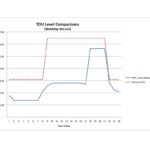

Reuters reported that the cost of tungstate-APT, a chemical used in manufacturing tungsten-based products, had reached its highest level since 2014.

At the time, an index that tracks indium prices outside China reached a 10-year-high.

As new developments unfold, this post China tightens crucial metals export limits as Trump’s Tariffs Take Effect may be updated.

This site is for entertainment only. Click here to read more