China kept key lending rates the same on Monday, for the third consecutive month. The country is seeking to maintain its currency stability in anticipation of further monetary ease to help support the economy.

The People’s Bank of China maintained its one-year prime loan rate at 3.1%. Meanwhile, the five-year reference mortgage rate remained unchanged at 3.6%.

LPRs are calculated by the central banks based on 20 contributions of commercial banks.

China’s economy showed stronger-than-expected growth in the final quarter of last year, bolstered by stimulus measures introduced since September. This performance allowed the economy to reach its target for annual growth.

China has achieved its growth goal, with the economy growing by 5% annually in 2024. According to the National Bureau of Statistics, China’s GDP reached 134.9084 billion yuan (18.77 trillion dollars).

Analysts warn, however, that the growth may be dampened by underlying issues, such as weak consumer demand and a struggling real estate sector.

Pan Gongsheng, the PBOC governor suggested that a decrease in the Reserve Requirement Ratio (RRR), could be introduced by 2024 in order to increase bank lending. This cut is yet to be implemented despite adopting a moderately loose monetary policy.

In July, the central bank had lowered rates for short and long term lending. It then introduced another 25 basis point reduction in October.

China’s financial policy by 2025

Investors hope for further interest rate reductions this year. China’s leaders signaled in December a move to “moderately lax” monetary policies as a way to boost growth.

China’s Politburo said earlier this month that it will adopt a “appropriately liberal” monetary policies in 2025. This is the first time in 14 years they have loosened their stance.

This has led to a historic drop in government bond rates, which is putting pressure on the US dollar and the yuan.

The yuan has recently dropped to its lowest point in over 16 months. This prompted PBOC officials reiterate their commitment towards preventing “overshooting” of the exchange rate.

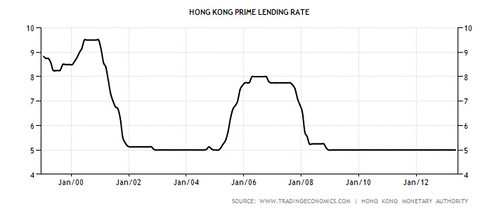

To stabilize the currency, Hong Kong has issued a record number of bank notes and suspended certain purchases of government bonds.

Analysts suggest that despite these interventions the yuan could remain under pressure because of the deflationary outlook for the country.

Trade tensions could be a cause for concern, especially as Donald Trump, the US president-elect, is set to take office this week and may increase tariffs against Chinese imports.

In a note published recently, Erin Xin wrote that the PBOC may need to adopt a more balanced approach in order to maintain exchange rate stability.

She expects that the central bank is going to reduce interest rates by 0.3 percent points this year, and the reserve ratio will be lowered by 0.5 percent points. Reserve requirement ratio is the percentage of bank deposits that must be held in reserve.

As new information becomes available, this post China maintains benchmark lending rates for third straight month could be updated.