Even though the S&P 500 is still close to record highs, traders are on edge because of recent stock market declines.

The CBOE VIX Index, Wall Street’s fear gauge has increased by 11% despite a 0.9% two-day drop, suggesting that market participants may be wary of an even deeper correction.

This week, momentum stocks that had been driving the market rally for months showed signs of weakness.

Concerns have been raised by the reversal of popular plays Monday and the subsequent decline in S&P 500 Tuesday. This suggests that there may be a weakness in market momentum.

The broader picture is still relatively positive. S&P is up 26,5% for the year to date and just under 1% away from its previous record.

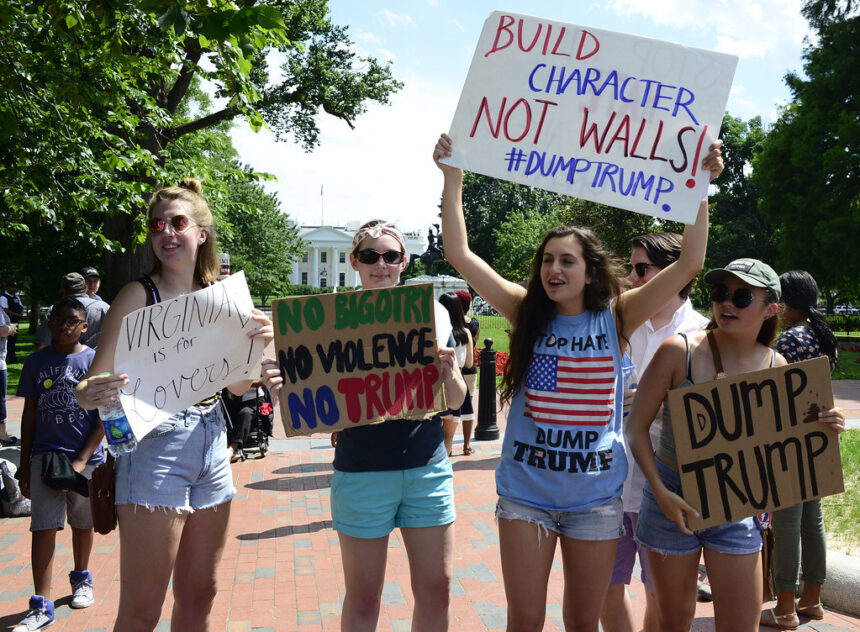

Many investors attribute the recent rally to the “Trump Trade” — an investment in stocks that are expected to gain from the policies of President-elect Donald Trump.

The trend of supporting key industries like defence and technology has been gaining momentum, particularly as the results of recent elections signalled that pro-business policies will continue.

Cathie Wood and ARK Funds rally for Trump’s reelection

Cathie wood, best known for the ARK Innovation ETF(ARKK), is experiencing a resurgence following Trump’s reelection.

ARKK, a famously high-growth stock that invested in Tesla, Roku and Twilio stocks, fell dramatically by mid-2021, but it has regained its momentum since Trump won the election, with a jump of 27.6%.

Tesla’s resurgence is a key driver for ARKK, as it represents 10% of its fund.

ARKK has been outperformed by another ARK ETF, Next Generation Internet ETF, ARKW.

ARKW’s exposure to Trump-friendly sectors, like crypto and defense, has increased by 29.5% since the elections.

Following the recent rise in Bitcoin’s price, the fund has gained substantial value by investing 11.5% of its assets in the ARK21Shares Bitcoin ETF. This shows the increasing interest in cryptocurrency in a crypto-friendly, pro-business administration.

ARKW: A stronger proxy for Trump 2.0

Todd Sohn, ETF & technical strategist, Strategas Securities, argues that ARKW, a better bet, is for investors looking to profit from Trump’s second-term.

ARKW, with its Tesla stake of 10%, along with Palantir Technologies, and Bitcoins, stands out as a direct proxy for so-called Trump 2.0 trade.

Palantir, whose growth is partly driven by the hope of increased contracts with government defense departments, has a greater appeal to ARKW.

The fund also includes exposure to cryptocurrency-related stocks like Coinbase and Robinhood, which are seen as benefiting from Trump’s crypto-supportive stance.

The outlook of ARK ETFs as well as the broader Market

ARKK funds have experienced outflows despite the recent rally.

Sohn notes that there are more than 2,600 ETFs available, but past success does not guarantee future success.

ARKW is a good option for investors who are bullish about Trump’s market policies. It has exposure to sectors such as crypto, Tesla and defense.

The bullish market trend, driven by Trump’s trade policies and other favorable factors, continues to drive certain ETFs up to new heights.

Cathie Wood Fund: This is not Trump 2.0! ARKK will be updated as new information unfolds