Copper prices are expected to rise for the rest of 2024, based on the fundamentals.

Copper is an extremely versatile metal that is widely used for electrical wiring and renewable energy infrastructure.

Copper prices are currently supported by expectations of more stimulus in China, and rates cuts in the US.

The question is whether the copper price can fall below $10,000 per tonne in the coming months.

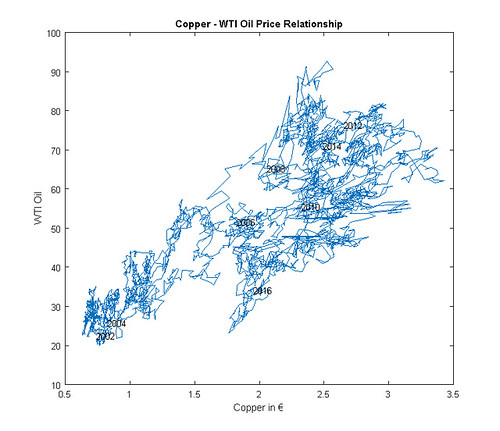

Prices of copper around the globe

China, the world’s largest copper market, saw a slight recovery on its physical market in August.

Fastmarkets reported that the copper cathode grade A premium saw an increase in Shanghai, reflecting better market conditions.

Fastmarkets stated in a recent report that the recovery is driven by an expectation of improved import arbitrage after the LME’s decline. However, there are still challenges due to price fluctuations.

Fastmarkets reported that copper prices in the US remained steady, due to a seasonal summer slump, and premiums stayed the same in the Midwest.

The red metal is in high demand in green energy and supply disruptions are expected to increase prices in the next few months.

Prices in Germany remain low due to the sluggish automotive and manufacturing industries. Stocks are also a factor that affects sentiment.

Rest of the 2024

If global fundamentals remain positive, copper prices will likely rise from October to December. The London Metal Exchange’s (LME) prices could drop below $10,000 per tonne from the $9,777.50 currently.

China’s Finance Ministry will hold a Saturday press conference to discuss further measures to stimulate the economy.

China is the largest consumer of metals worldwide. Demand for commodities is expected to increase as China’s economy receives more support.

Beijing announced several measures last month to boost its economy. These included interest rate cuts and targeted assistance for the real estate sector. This sparked an upswing in industrial metals, with prices rising 7.6% just for September. Prices had also moved past the psychologically-crucial barrier of $10,000 per ton level before giving up the gains.

Copper prices have been influenced by China’s economy.

Copper and iron ore lead the way in industrial metals last month.

Copper is supported by the expectation that US Federal Reserve will cut interest rates at its meeting in November.

The market expects the Fed to reduce interest rates in the future by less than a higher percentage, but the lower quantum is still bullish for commodity prices.

Low interest rates are good for commodities that don’t yield much, such as copper. This also improves the liquidity of the system while the borrowing costs are reduced. Investments in commodities like copper increase.

The Fed has cut rates 50 basis points since its last meeting.

Fastmarkets analysts said this in a recent report.

The Shanghai premium is expected to continue recovering in China during the last quarter of this year. This will be mainly due to an improved mood following the significant stimulus measures taken by the authorities.

China needs more stimulus and more easing

The analysts at ING Group believe that China’s economic stimulus announcements last month are a positive step.

Lynn Song, ING Group’s China economist said, in a “note”

The momentum may recover in the fourth quarter if there is a significant fiscal policy initiative.

According to the economist, stabilization of China’s property market is necessary to boost copper demand. Property is important for the industrial metals.

First, prices must stabilize if they are not to recover. We need excess housing inventories to return to historical norms. “Until that time, growth will be slowed,” Song said.

Longer-term outlook for copper prices

Copper’s long-term trajectory is bullish beyond 2024. This is especially true with the increased focus on the green-transition, which will likely generate greater demand for this red metal.

Analysts at Fastmarkets stated that the premium for copper cathode grade A in Rotterdam will rise approximately by 25% by 2025, reflecting tighter fundamentals regionally and a recovering European Market.

The world is expected to transition to electric cars from the fossil fuel vehicles in the coming decade.

Experts predict that copper will be used more in the infrastructure of renewable energy sources, which could drive demand.

Fastmarkets reports that “the anticipated structural deficit will probably necessitate an increase in investments in production equipment, further underpinning the bullish outlook on copper prices.”

Copper ore imports in August were a pleasant surprise. They reached 2.6 million tonnes, the second highest monthly total ever. Commerzbank AG said that this has allayed fears of a copper ore shortage limiting the recent rapid expansion in Chinese copper production.

Barbara Lambrecht is a commodity analyst with Commerzbank. She said this in a recent report. :

If September’s figures are disappointing and August appears to be an anomaly, then this will support the price of copper.

The post Copper prices can they reach $10,000 once again? This post may change as new information unfolds

This site is for entertainment only. Click here to read more