As attention shifts towards the upcoming European Central Bank interest rate announcement, the CAC 40 has performed well in 2018. It is currently hovering around its highest ever level. On Thursday it was at EUR8,173, just a few points off the record high of EUR8,260.

European Central Bank decision ahead

CAC 40 has increased in value this year. This is similar to other European indices such as the German DAX or Spain’s IBEX 35. Stoxx 600 and 50 have reached their highest ever levels.

Investors ignored Donald Trump’s recent warnings about tariffs. Trump hinted at a 25% tax on European products as part of his efforts to reduce the current trade deficit between Europe and the United States.

He thinks that the tariffs would encourage European firms to relocate to America, a market of critical importance. Trump hopes that tariffs will raise revenue and be offset by lowering taxes for consumers and business.

However, the US may suffer if it retaliates because Europe is one of America’s largest buyers.

Next, the upcoming interest rate announcement by the European Central Bank will have a major impact on the CAC 40. The bank is expected to continue reducing rates in order to boost the economy. The recent ECB rate cuts helped support European equities including those of France.

Chinese Economic Recovery

Investors are focusing on the Chinese economy, which has led to a good performance for the CAC 40. Beijing set itself a 5% growth goal for the year, despite its trade war with America.

This week, macro data showed the Chinese economy is recovering. The manufacturing and service PMI numbers, for example, have been above 50.

CAC 40 companies have a high exposure to China’s economy. Luxury group companies such as LVMH Kering and Hermes have earned billions in China.

Analysts believe that this Chinese economy is going to do very well, and will be a catalyst for these French firms. With tensions rising between Europe and America, it is likely that both countries will turn to China.

French stocks are also doing well, as European countries pledge to increase spending in defense, particularly.

Top CAC Index Movers in 2025

The majority of companies included in the CAC 40 Index have performed well, and many are up by double-digits.

Thales’ stock price has increased by 76% in this past year. This makes it the top-performing index company. The company’s stock price grew as demand for its main segments, such as defence, aeronautics, and cyberspace, increased.

The stock of Societe Generale has increased by more than 48% in the past year. BNP Paribas Bouygues Sanofi and EssilorLuxottica all saw double-digit increases.

RHM stock has risen 95% since 2025. Can it continue to rise?

CAC 40 Index Analysis

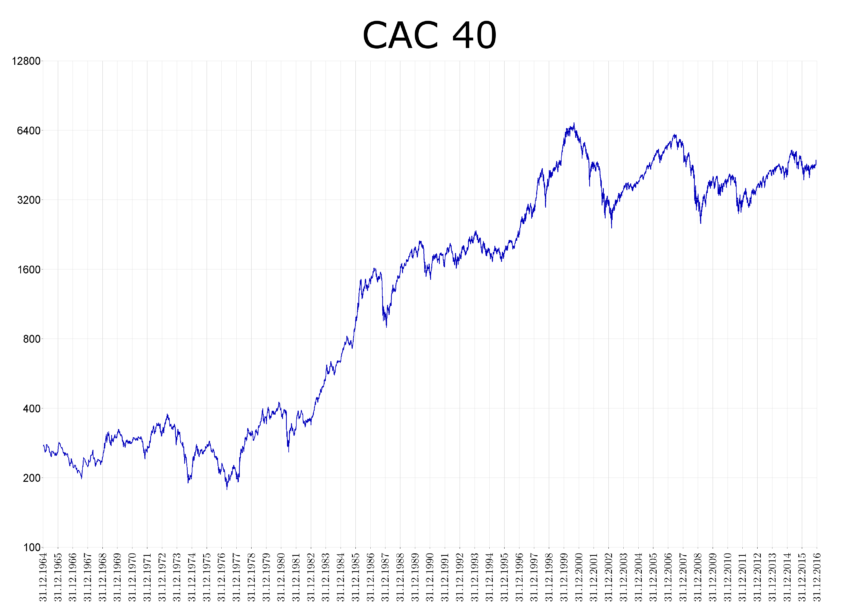

TradingView CAC Index Chart

On the weekly chart, the CAC 40 has surged over the last few months. The index has been above the trendline ascending that links the lowest swings from September 2022.

It has risen above the moving averages. It has also formed an ascending triangular pattern, whose upper side is EUR8,247. This triangle is one the bullishest continuation signals.

CAC has been above Ichimoku’s cloud indicator. The stock is therefore likely to continue rising, as bulls aim for the next psychological level at EUR8,500. If it rises above EUR8,247, this view will become more pronounced. It could also drop to the trendline ascending.

The post CAC 40 Index Forecast: Here’s Why it Could Surge to EUR8,500 can be updated as new information unfolds