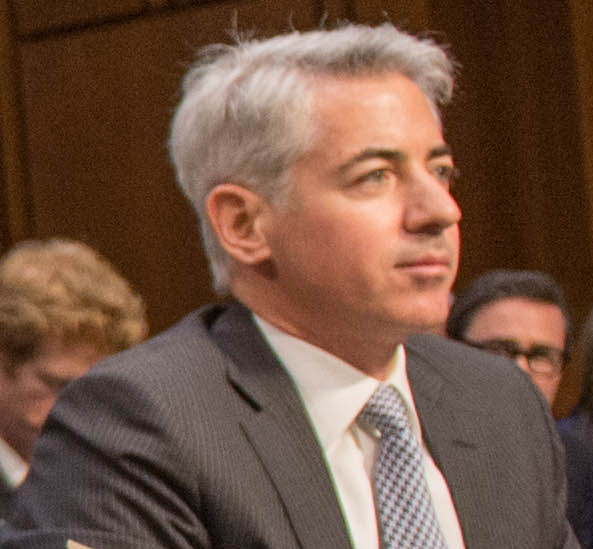

Bill Ackman, a billionaire hedge-fund manager, has acquired a large stake in Uber Technologies Inc. (NYSE: UBER).

The founder and CEO of Pershing Square, who owns more than 30,000,000 shares in the ride-hailing company, announced on Friday that he had owned the stock for over a year.

His stake in Uber totals $2.3 billion.

Ackman bought UBER shares at an average of $75 per share, which he called a “massive bargain” on X.com today.

The shares of this mobility company have fallen about 13% from their highs for the year to date.

What makes Bill Ackman so bullish about Uber?

Bill Ackman bought Uber shares in January of this year, because “it’s one of the most well-managed and high quality businesses” on the planet.

In his tweet, he said that the New York listed firm was trading at a substantial discount to its value as of writing. This combination is “extremely low, especially for a company with a high market cap.”

Dara Khosrowshahi is the leader of the hedge fund, and the manager of the hedge funds has great confidence in her leadership. This despite the fact that the company’s recent quarter was below expectations in terms of revenue.

Uber isn’t a good pick for investors looking to earn income, as the stock does not pay dividends.

Ackman was an early Uber investor

Bill Ackman is a long-time customer of Uber Technologies Inc., having made an investment in the company through a venture capital fund back when it was founded.

Hedge fund manager Khosrowshahi has the confidence of the hedge fund manager because, “since taking the reins in 2017, he has done an excellent job in turning the company into highly profitable growth machine that generates cash.”

The chief executive of Uber even said in a recent interview that commercializing autonomous vehicles was only possible if Uber and the AV sector worked together.

Wall Street shares Ackman’s enthusiasm for Uber. Analysts expect the stock to rise up to an average of $89, which is a 20 percent gain.

Bill Baruch has recently acquired UBER

Uber’s fourth quarter revenue was higher than expected, despite missing this week on earnings.

Bill Baruch is the president and founder of Blue Line Futures. He also bought shares in the company after its earnings announcement.

Uber’s Q4 fiscal bookings increased by 18% on a year-on-year basis for both its delivery and mobility services.

It ended the third quarter with 171 millions monthly active users, up 14% from the previous quarter.

Uber’s stock price has recovered all of its post-earnings drop.

What’s Bill Ackman betting on? This post may change as new information becomes available

This site is for entertainment only. Click here to read more