-

Alderoty: SEC’s withdrawal of appeal marks a shift towards clear crypto policy

-

XRP Price Holds $2.20 in June as Whales Continue Buying through Volatility

-

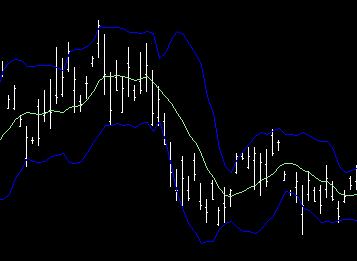

Bollinger Bands and RSI show XRP is gaining momentum to retest $2.30

Stuart Alderoty is Ripple’s Chief legal officer. He recently shed light on how the United States Securities and Exchange Commission (SEC) abandoned its appeal against Ripple in March 2025.

Alderoty, speaking at a “Crypto in One Minute” session shared through Ripple’s channels, noted that the SEC move represents a broader recognition that enforcement actions can’t be pursued effectively without clear regulatory frameworks.

He emphasized the lack of established laws governing cryptocurrency in the US. He stated that the focus would now shift to collaborating with Congress on establishing “smart crypto regulations” that protect consumers, market integrity and foster innovation.

Market Dynamics Shift – Spot demand driving XRP rally?

Market analyst Dom highlighted a significant change in the XRP market behavior as compared to previous cycles, starting around 2020.

Dom noted that historically, the perpetual futures market often led spot prices for XRP. This is a sign of speculative bubbles driven by leverage and prone to sharp price corrections.

Market data from early 2025 shows that the spot market price is higher than futures. Dom and sources such as Cointelegraph report that this indicates the current price strength is backed by genuine spot demand, indicating a stronger rally than previous speculative rallies.

Whale Accumulation Continues Due to Volatility

Glassnode data shows that the number of addresses with at least 10,000 XRP has been steadily increasing since November 2024. This accumulation of larger holders (also known as whales) often indicates a conviction in the longer-term prospects of an asset.

This whale accumulation trend continued despite a 35% price drop between January and April of 2025. This indicates a strategic XRP acquisition rather than short-term speculating. Since the beginning of this period in late November 2024, XRP has risen by about 350%.

XRP Technical analysis (early May 2025).

XRP, from a technical perspective, was trading between $2.21 and $2.23 as of the early hours of May 3, 2025. The price is currently testing the support near the Exponential Moving Average (20-day EMA) around $2.18-$2.20. If this level is not held, the price could return to the $2.00 psychological threshold.

According to the chart below, RSI is currently around 53.85. An RSI over 50 indicates a bullish trend, indicating that the buying pressure is currently greater than the selling pressure. The RSI is still not in overbought (typically above 70%), indicating that there may be room for more upward movement.

Bollinger Bands indicate that the upper Bollinger Band lies around 2,3059, while the middle Band (20 day SMA) is located at 2.1649 and the lower Bollinger Band at 2.0239. Currently, XRP trades above the middle Bollinger Band. This is often viewed as a bullish sign and a retest to $2.3 is likely.

This site is for entertainment only. Click here to read more