Latin America’s crypto landscape has undergone significant change, and stablecoins are emerging as the most dominant class of digital assets in the region.

A recent Chainalysis study shows that Latin Americans are increasingly using stablecoins to find financial stability in the face of economic difficulties.

This report shows that stablecoins accounted for most of the transfers below $10,000 during the second quarter 2024. It highlights their importance in daily economic activity.

In a study by Chainalysis, entitled “Latin America Searching Economic Stability: Stablecoins Rising Amid Volatility,” it is noted that several Latin American nations surpass the average global retail transaction volume for stablecoins.

Currency like USD Coin and Tether, both tied to the US Dollar (USDT), are popular among consumers who want to protect their savings from high inflation.

The trend shows the increasing reliance of stablecoins in an environment that is characterized by rapid devaluation of traditional currencies.

SatoshiTango deposits dollars in Argentina

SatoshiTango, in response to Argentina’s economic instability and inflation escalating, has launched a feature that allows users to withdraw and deposit US dollars from their digital wallets.

The crypto industry in Argentina has taken a major step forward with this development, which provides residents with an important tool to manage their finances during difficult times.

In Argentina, the introduction of dollar deposit meets an urgent need. The US dollar is seen as a haven from the falling peso.

Many citizens who are trying to manage economic uncertainties find it essential to be able to easily and seamlessly manage their dollar assets.

Matias BARI, SatoshiTango CEO, said that the initiative aims at simplifying financial transactions in Argentina, by making them more efficient, secure and easy to manage.

Bari noted also that this feature is in line with the broader vision for the company to bridge traditional finance and cryptocurrency, creating a more integrated ecosystem.

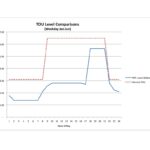

Cross-border payment in Mexico: TruBit and reap

TruBit, an ecosystem of digital assets in Latin America has also partnered with Reap – a provider of payment technology – to simplify financial processes in Mexico and help nearshoring.

The strategic partnership will offer companies faster and more cost-effective solutions for cross-border payments, while also addressing the demands of Asian businesses expanding their operations into Mexico.

Nearshoring growth

The practice of nearshoring, which involves relocating operations to markets closer by, has gained popularity in recent years. This is especially true after the US/China trade conflict.

According to a recent Deloitte report, Nearshoring in Mexico, Asian investments in Mexico have increased by 280% since 2018.

Mexico is a strategic location for growth and investment due to its close proximity to the United States.

This development signals a new phase in Latin America’s financial and crypto sectors. It is driven by the necessity for stability and strategic partnerships as well as opportunities that arise from geopolitical shifts around the world.

This article LATAM Crypto Update: Stablecoins Lead in Use Cases; Argentina’s SatoshiTango Launches Dollar Deposits appeared first on ICD

This site is for entertainment only. Click here to read more