XRP has been under pressure since it was revealed that Chris Larsen (Ripple co-founder) is funding Kamala Harris’ campaign for the presidency. Ripple traded at $0.50, just a few tenths above its October low of $0.4870.

The XRP coin has fallen by nearly 32% since its peak this year. The XRP token has underperformed the majority of cryptocurrencies, including Ethereum, Bitcoin and Justin Sun’s Tron.

Ripple is a Ghost Chain?

The XRP has fallen sharply due to concerns over the fundamentals of the network. Since there is not much movement in the Ripple network, most analysts think that Ripple’s network has turned into a “ghost chain”.

Ripple began as a way to address the problem of sending money overseas. This is because for many years, these transactions were a costly and slow process.

RippleNet offers a Real-Time Gross Settlement (RTGS), which is facilitated through the XRP crypto currency, to banks and financial service companies.

Many banks, however, have given up on the network, particularly after legal problems in the United States. Some banks, however, have created their own tokenized systems to transfer money within the bank.

MoneyGram and other companies have also incorporated Stellar’s technology in order to transfer funds via stablecoins. The USDC stablecoin can be sent and the money withdrawn globally.

SEC prepared January 2025 Brief Submission for XRP Case. Read More.

XRP ledger & RLUSD stablecoin

The XRP Ledger is not seeing any significant activity from developers. This is Ripple’s Ethereum competitor that allows the creation of several assets.

Ripple had hoped its network would be popular with developers from industries such as DeFi and Gaming. Data shows, however, that there is no significant developer in the ecosystem. It has a TVL of less than 5 million dollars. Base, Blast and Sui are among the newer networks that have grown to be bigger than ledger.

Ripple has now tied its growth to the RLUSD, a stablecoin that will be a regulated currency in the United States. The RLUSD stablecoin will be 1:1 backed by the US dollar.

The RLUSD, on the other hand, competes in the industry that is the most competitive in the crypto-sector.

With assets of over $120 Billion, Tether (USDT), the largest cryptocurrency in the market has the most share. The second largest cryptocurrency is USD Coin with assets of $35 billion.

Previous attempts at disrupting the industry failed. PayPal USD (PYUSD) is the best example. It was introduced in 2023. One year after its launch, the stablecoin has $533 million worth of assets. It has also a small market share. There are therefore high odds that the RLUSD will fail.

XRP’s price also hasn’t performed well due to the legal disputes with Securities and Exchange Commission. Harris will give a favourable response to Chris Larsen the Ripple billionaire.

The amount of XRP in escrow is down to 38.9 Billion, from 55 Billion a few short years ago.

Read more about why Ripple’s $125m fine will not go to SEC despite XRP suit

XRP price prediction

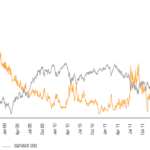

TradingView XRP Chart

This daily chart shows why Ripple’s price may be under greater pressure once the elections are over. At $0.6415, it formed a three-top pattern. This is usually a bearish pattern in most markets.

Ripple also has a death-cross formed when the Weighted Moving Avg. 50 and 200 days have crossed. There is therefore a chance that the coin could crash, and then retest its crucial support level of $0.3830. This is the lowest level it reached on July 5th, which is 24% lower than the current price.

If the XRP rate drops below $0.4870 (its lowest level in October), this view will be confirmed. A move above the moving averages of 50 percent at $0.52 would indicate more gains for the short term.

This article XRP Price Prediction: Ripple at Risk of a Breakdown appeared first on the ICD

This site is for entertainment only. Click here to read more