-

In just three months, the revenue from Pump.fun has dropped by 83%.

-

Trading volume has fallen by 75% on the platform amid a slowdown in the meme coin market.

-

The platform faces additional difficulties with fraud concerns, legal issues, and security breaches.

Pump.fun is a platform that was central to Solana’s meme coin boom in the past year. Protocol fee revenue and trading volume continue to decline sharply. The current data shows a dramatic difference between its peak activity in 2025 and the current data.

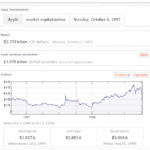

According to DefiLlama, the protocol fee revenue for Pump.fun as of March 28 is $1.2 million. This is a significant decline from January’s revenue of $7.07million. This is a significant drop of 83% from the all-time highest revenue in just three short months.

The steep decline in user activity is a sign of a significant contraction. The platform is now facing a significant loss in revenue and market share within the Solana meme currency ecosystem.

Related: Pump.fun: Why Did We Launch Our Own DEX, pumpSwap?

Does the decline reflect a wider slowdown in the Meme Coin Market?

Pump.fun’s trading volume has also seen a sharp decline. As of Friday, daily volume was $97.21 millions, compared with $390.3 millions in January. This is a 75% drop from its peak.

The decline in Pump.fun’s revenue and trading volumes is part of a wider slowdown in the market for meme coins, which had seen massive expansion in 2024.

Binance released a report that revealed meme coins to be the top performing crypto sub-sector for 2024. The average gain was over 212%. Pump.fun and Solana were key in making Pump.fun the blockchain of choice for trading meme coins.

Pump.fun generated over $400 million in revenue by 2024.

Related :Solana based Pump.fun is the top player in Meme Token deployment

The market sentiment has changed significantly since 2025. Initially popular because of perceived “fair-launch” opportunities, many now see the sector as increasingly fraught by fraud and manipulation risks.

Platform woes: Account hack and securities lawsuits add pressure

Pump.fun was compromised recently, adding to the platform’s woes. On February 26, the official Pump.fun X platform account was hacked. It was used to promote fraudulent tokens including a fake PUMP governance token.

Related :Pump.fun Sued in Class Action Lawsuit for Securities Violations

Separately, in January, Pump.fun was the target of lawsuits filed by investors. One suit claims that the platform’s ease of token launch process made it easier to create and promote unregistered securities. It also claims that influencers were misled, resulting in investor loss. This suit seeks to revoke token purchases, damages and attorney’s fee.

This lawsuit followed a similar one filed earlier, which accused Pump.fun, in addition of alleged violations of securities law, of allowing the promotion inappropriate content through its platform.

This site is for entertainment only. Click here to read more