-

Mt. Mt.

-

Bitcoin holdings drop by $32,97M due to market volatility. Gox’s $3.03B portfolio.

-

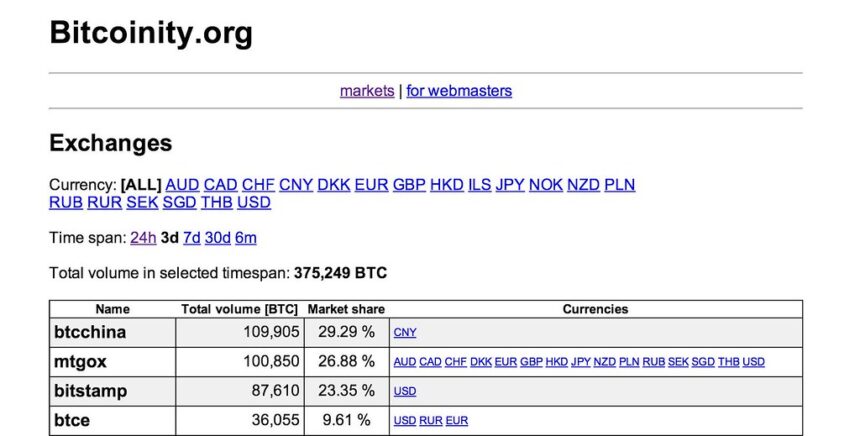

Key indicators suggest a cautious market sentiment despite increased trading activity.

Arkham, a blockchain analytics firm, reports that Mt. Gox has sent Bitcoin worth approximately $2.2 billion to unmarked wallets. This transfer follows a smaller transaction involving 500 BTC last week, raising questions regarding the motives behind the movements.

Mt. Gox’s most recent activity is its largest Bitcoin transfer since late September, further fueling interest about its holdings.

After these transfers, Mt. Gox currently has a total balance worth $3.03 billion, or approximately 44,378 BTC at the current Bitcoin price of $68,371. Recent market volatility has affected the valuation of this portfolio, resulting in a loss of approximately $32.97million.

This loss is in line with Bitcoin’s recent $743 drop, showing how volatile large crypto holdings can be. Mt. Gox’s large holdings highlight the value of cryptocurrencies due to their scarcity.

Mt. The Bitcoin holdings of Mt.

An analysis of Mt. Gox’s Bitcoin portfolio from 2016 to 2020 shows that the value of the portfolio remained relatively stable and low until late 2020. This period marked a pivotal point, coinciding the broader crypto-boom that propelled Bitcoin all-time highs.

Read also:Mt. Gox Moves $500 BTC as Bitcoin Price Tests Support of $69,000

The portfolio’s value peaked in 2021. It experienced sharp increases and drops that reflected Bitcoin’s inherent volatility. In 2022, holdings reached near-peak levels again before falling and recovering partially. This trend has continued through 2023 and 2024.

Bitcoin Price Action and Market Analysis

Mt. Bitcoin’s price dropped 1.04% in the last day, trading at $68,346.39. Trading volume increased by 25.15 percent to $41.19 Billion, indicating that the market is responding to recent price changes.

The price chart for the day reflects a volatile pattern, with Bitcoin beginning at around $69,000 and dropping to a low of $67,000 before recovering above $68,000.

Technical indicators can provide additional clues to the current market mood. The MACD indicator shows a positive histogram but the lines are convergent, which could indicate fading momentum or a possible trend change.

RSI is currently at 53.41. This puts it in a neutral area, not oversold or overbought. The RSI dip suggests that previous buying pressure may have cooled.

This site is for entertainment only. Click here to read more