-

Ethereum’s daily ETH Burn Rate is approaching zero, indicating a significant reduction in network profitability and activity.

-

A slowdown in DeFi and lower on-chain activity are likely to be the main reasons for the drop in transaction costs and ETH burns.

-

This trend challenges ETH’s deflationary narrative, and could dampen future staking reward if network usage does not recover.

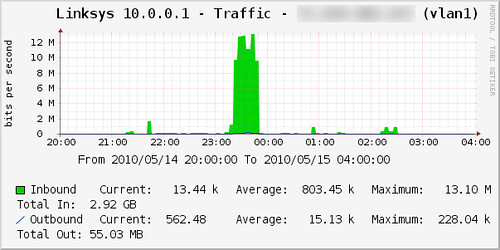

According to a recent chart analysis by Miles Deutscher, Ethereum’s daily ETH burning rate, a feature introduced by the EIP-1559 update in 2021 for managing fees and supply management, is showing signs of decline.

The chart shows Ethereum’s profitability at its lowest in a very long time. ETH burns are trending towards zero. This implies a reduction in network usage or fees. This is contrary to Ethereum’s deflationary idea, which relies upon burning more ETH that is issued to validators.

The trend has caused debate in the crypto community. Some see it as a temporary lull, before a possible recovery. Others express concerns about profitability metrics and possible shifts in market sentiment.

Why are ETH Burns declining?

It’s important to first understand what is actually happening.

Ethereum’s revenue comes primarily from network activity which generates transactional fees. Falling fees indicate a lower demand for blocks, which means fewer users will pay high gas charges. Lower fee revenue can affect validators and Ethereum stakeholders, making ETH a less attractive yield-generating asset.

It’s difficult to pinpoint the exact reasons for Ethereum’s decline. However, lower on-chain activities could be one. This means that Ethereum’s DeFi ecosystem is slowing down, with lower trading volume and fewer transactions on its mainnet. Since Ethereum’s burn mechanism depends on gas fees, lower fees will result in lower burns. Moreover, fewer transactions with high fees means less ETH burned.

It’s important to note that this is all speculation, and there’s no need to worry just yet.

What are the potential implications?

It may be too early to predict what the news will bring, but there are a few things that you should consider.

In the case where burns exceed issuance, ETH will become deflationary. A trend towards zero burning could lead to a resurgence of ETH’s total supply, which would have a negative impact on its perceived long-term values.

Ethereum validators are rewarded by MEV (Maximal Extraction Value) and transaction fees. If fees are low, staking rewards will decrease, which could discourage Ethereum staking.

Ethereum’s burn-rate and profitability could quickly rebound if on chain activity returns, whether through new innovations, increased DeFi volumes or something else.

This site is for entertainment only. Click here to read more