The central bank of Ecuador (Banco Central del Ecuador or BCE), has stated that digital assets are not legal and therefore cannot be used for official electronic payments.

BCE made the statement in response to an increasing number of Ecuadorians engaging in cryptocurrency transaction, especially through the Worldcoin Project, where thousands of people have received a basic income universal in the form 60 WLD tokens.

Worldcoin’s public engagement and impact in Ecuador

Worldcoin is a new cryptocurrency that was launched just a couple of weeks ago in Ecuador. It has gained a lot of attention with hundreds and thousands Ecuadorians taking part in it.

According to social media, hundreds of people gathered at Guayaquil – one of Ecuador’s biggest cities – in order to register with Worldcoin. Orbs were placed on designated sites that scanned the iris of participants.

The BCE, despite the increasing popularity of Worldcoins and other digital currency options in Ecuador, has stressed that only the US Dollar is legal tender.

Article 94 in the Organic Monetary and Financial Code and the Monetary and Financial Regulation Policy Board’s (JPRM), resolutions released in August 2023 and February 2022, reaffirm this position. The US dollar is the currency of all transactions in the country, as well as for monetary and fiscal processes and accounting records.

Classification of payment methods and restrictions on cryptocurrency

JPRM-2023-014-M. On August 7, 20,23, JPRM clarified further the classification of payments methods in Ecuador by Resolution No. JPRM-2023-014-M.

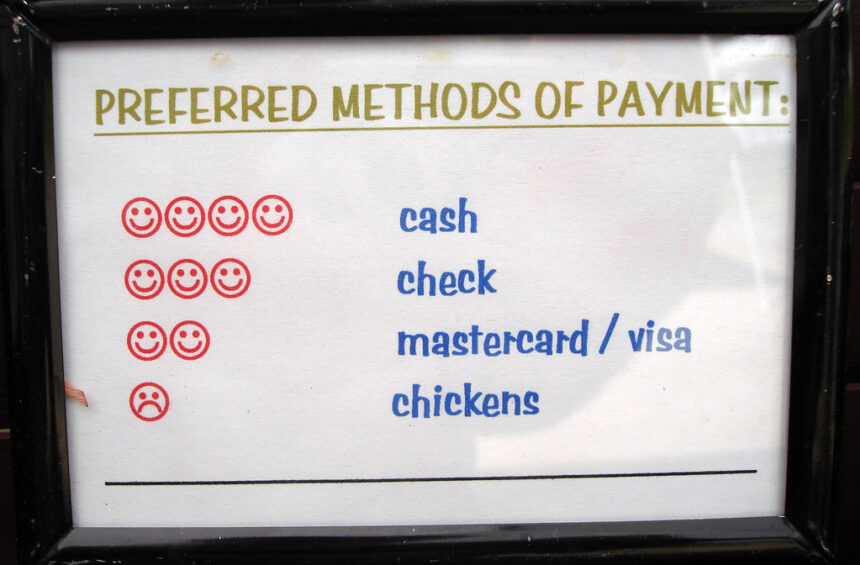

This resolution categorizes payment methods into three categories: electronic payment methods (e-payments), electronic wallets, and physical payment methods.

Payments can be made electronically using electronic funds transfers, debit and credit cards and pre-paid cards.

In Ecuador, cryptocurrency is not considered legal tender, which means that it cannot be used as a payment system.

Ecuador’s crypto market is growing despite regulations

Ecuador’s cryptocurrency market has been active despite these restrictions.

A report by the US-based Blockchain data company Chainalysis entitled “Geography of Cryptocurrencies, 2023” shows that Latin America represented approximately 7.3% of total digital asset value between July 2022 to June 2023.

Ecuador was ranked 7th in the world for the total value of cryptocurrency received during the period, estimated at USD 7 billion.

According to the report, Ecuadorians acquire cryptocurrency through a variety of methods, such as cash payments, debit or credit card transactions, and local transfers.

However, the high volume of cryptocurrency transactions–totaling billions of dollars–raises questions about the primary methods of payment used.

These transactions would likely have resulted in a large outflow of currency, resulting in a decline of the International Reserves.

Reminders on regulatory issues and digital assets’ future in Ecuador

JPRM & BCE remind citizens & businesses in Ecuador that cryptocurrency is neither legal tender or a valid method of payment.

The regulatory environment for digital assets in Ecuador is still strict. Authorities stress the importance of following existing laws to ensure economic stability and integrity.

The growth of crypto projects such as Worldcoin, in Ecuador, highlights ongoing challenges and potential in the digital assets landscape.

The central bank of Ecuador maintains its firm position on the legality of crypto assets, but the growing engagement of Ecuadorians with the cryptocurrency market indicates that demand will continue to grow.

The regulatory environment in Ecuador will be crucial for shaping the future use of cryptocurrency within the nation.

The post Ecuador’s BCE reaffirms crypto ban amid Worldcoin growth may be updated as new developments unfold.

This site is for entertainment only. Click here to read more