The movement of digital assets and US stock is increasingly in sync, reflecting similar macroeconomic influences.

Recent correlation studies reveal that the correlation coefficient 40-day between the 100 largest cryptocurrencies and S&P 500 Index was approximately 0.67.

The figure is close to the all-time high 0.72, set in the 2nd quarter of 2022. This indicates a strong alignment between the two asset classes.

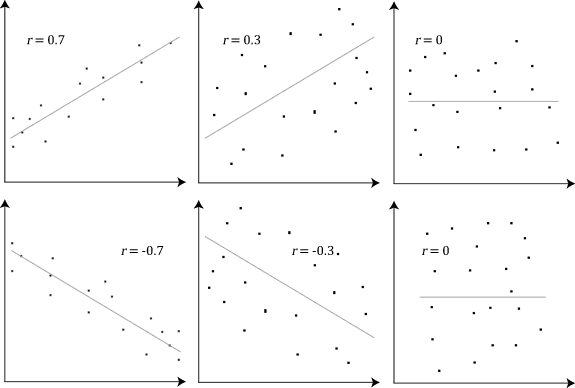

The correlation coefficient measures both the direction and strength of the relationship that exists between two variables.

In the past, cryptocurrency was viewed to be non-correlated and even anti-cyclical with traditional markets.

This perception, however, has changed during periods of economic insecurity.

Both the equities market and crypto markets are increasingly affected by the growing participation of institutional investors, as well as the common economic drivers, such a monetary policy and inflation.

Fed policy drives market synchronization

The Federal Reserve’s recent actions have strengthened this correlation.

US stocks hit all-time records, while Bitcoin surged to $64,000 after a rate reduction of 50 basis points, signaling a new era in monetary ease.

Caroline Mauron (co-founder at Orbit Markets) emphasized the trend by stating: “Macro-factors are currently driving crypto prices, and that should continue through the Fed’s easing cycles unless we have a crypto specific black swan.”

The market participants will be closely watching the comments of Fed officials, as well as the upcoming release date for the Personal Consumption Expenditures Price Index (PCE), which is preferred by the Fed to measure inflation.

Sean McNulty is the director of Arbelos Markets’ trading department. He said, “We consider the FOMC speakers to be more important than PCE inflation figures, because it’s their reaction function at this time that matters.”

Source :Bloomberg

2022, the year of unmatched correlation

In 2022, the relationship between US stocks and cryptocurrencies will have changed significantly.

The correlation between asset classes increased to unprecedented levels as the Federal Reserve tightened its monetary policy in order to fight rising inflation.

In the second quarter, the correlation coefficient between Bitcoins and S&P 500s climbed up to 0.72, showing how the two markets responded to inflation concerns, interest rate increases, and risk off sentiment.

Bitcoin, and the other main cryptocurrencies, mirrored risky assets such as tech stocks during this time, especially when both markets went into bear territory.

Early in 2023 the correlation was reduced to approximately 0.5%, due to some events relating specifically crypto, like the development of decentralized finance and regulatory developments.

Bitcoin, the biggest cryptocurrency, has seen a small rise, less than 1%. It now stands at $63,480. Other major digital tokens have also experienced similar gains.

The rise in US equity prices coincided with the increase in US futures. This was driven by increased expectations for further Chinese monetary stimulus and an interest in cryptocurrency and artificial intelligence investments following recent statements from US Vice-President Kamala Harris.

The evolving correlation between traditional and digital assets underscores for investors the importance of remaining vigilant on macroeconomic forces that shape both markets.

The post Crypto and US Stocks Show Record Correlation as Fed Policies Align Markets may be updated as new developments unfold.