-

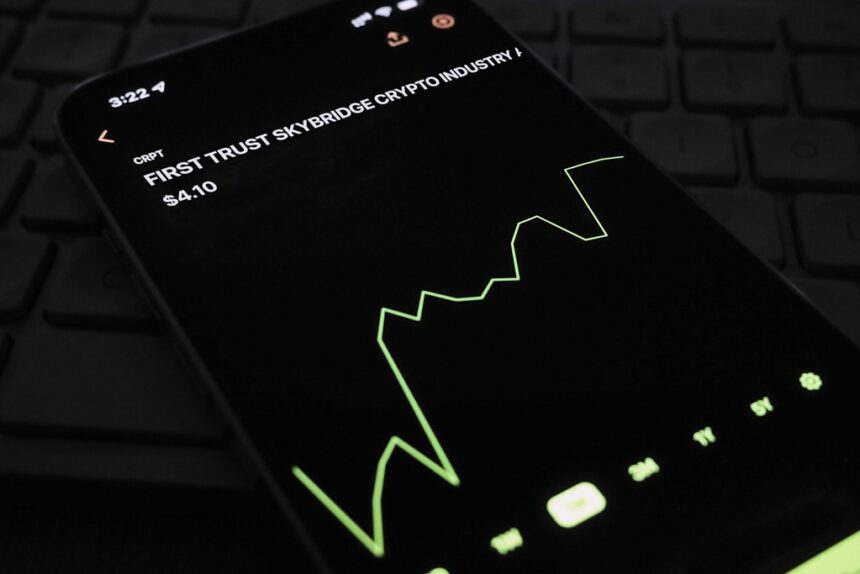

Crypto Industry Backs Trump’s 2020 Run, Seeking Regulatory Reforms to Boost Innovation amid SEC’s Strict Enforcement under Gensler.

-

Trump’s pivot towards a crypto agenda, including World Liberty Financial contrasts with stricter policies under the Biden administration.

-

The US crypto sector will be shaped by the November 2024 elections, as contrasting policies from Trump versus Harris will impact future regulations.

The crypto industry actively supports the 2024 US election, hoping for Donald Trump’s victory. This support is a result of his campaign promise to have a crypto-friendly agenda. Gary Gensler, the head of the Securities and Exchange Commission (SEC), continues to oversee regulatory oversight. He claims that the crypto sector is full scams as it allegedly violates established financial laws. Crypto players have increased their political donations to influence laws in their favor.

Crypto Sector’s Political Ambitions

The upcoming November elections will be pivotal to the crypto sector. The 435 House seats, 33 Senate seats, and the presidential race between Trump vs. Kamala Harris are all contested. The industry believes a Trump victory could lead to policies that boost cryptocurrency innovations. Trump launched World Liberty Financial in recent weeks, a venture that he claims will help advance crypto in America. He also envisions creating a national bitcoin reserve that would mirror the gold reserves.

Read about Crypto’s political spending spree: Freedom of Speech or “Monstrous Influence”?

Shifting Position on Cryptocurrency

Trump’s current support of crypto represents a change from his earlier skepticism. In 2021 he called Bitcoin a scam, and a danger to the dollar. He wants to make the US “the crypto capital of the world.” The Biden administration, on the other hand, has enforced stricter regulation, which has led several enforcement actions against major companies, including Binance, FTX, and others.

Continued Regulatory Pressure

Gensler has led the SEC to increase its enforcement actions against noncompliant crypto companies, citing investor safety concerns. The SEC filed 46 enforcement cases in the crypto industry last year. Binance founder Changpeng Zhao has been convicted and fined millions, while FTX’s Sam Bankman Fried received a 25 year sentence for fraud.

Public Interest Declines

A recent Federal Reserve study revealed a decline in US cryptocurrency usage, from 12% in 2020 to 7% by 2023. Some believe that crypto offers fast and secure transactions, while others view it as risky.

Harris’ Position on Emerging Tech

Kamala Harris is not vocal about crypto, but her advisers say she supports policies that promote growth for emerging technologies. Her campaign seems to be more focused on regulatory control than Trump’s proposed innovations.

Read: Harris’s Crypto push drives Bitcoin rally to $66K, outpacing traditional assets

Investor Protection: The SEC’s Position

Gensler stresses that securities laws are designed to protect investors by requiring firms to provide critical financial information. The SEC believes that crypto is a threat to the integrity of markets, despite its smaller size than traditional financial markets. While crypto advocates call for reforms, SEC is firm in its compliance.

The outcome of 2024’s elections could have a significant impact on the future of the US Crypto sector. The results of the 2024 elections will have a significant impact on the regulatory landscape for the crypto industry.

This site is for entertainment only. Click here to read more