-

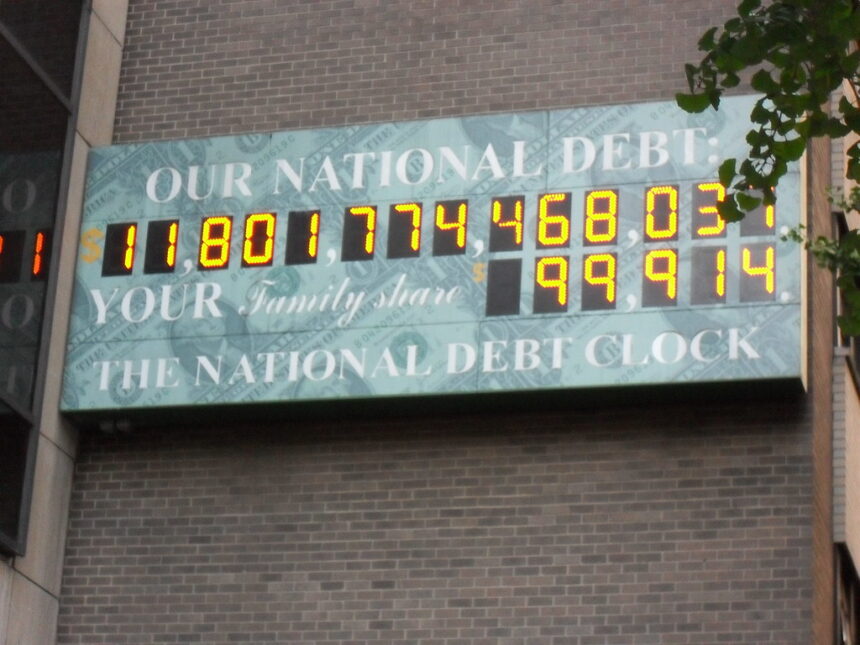

If elected in 2024, Trump plans to use Bitcoins to reduce the US debt of $35 trillion.

-

He wants the US to be the leader in the global cryptospace, surpassing China.

-

Trump attacked Biden, saying that the current president does not understand crypto.

Donald Trump, Republican candidate for the Presidential Election of 2024, sat with FOX Business’ Maria Bartiromo and discussed cryptocurrencies, crypto policies, as well as how he intends to make the United States the leader in the digital assets space. He also revealed his plans to reduce the US debt of $35 trillion by using Bitcoin, the most popular cryptocurrency.

In an interview with FOX held in Bedminster (N.J.) on Thursday, Trump stressed his goal of putting the United States at the top of the list for digital asset growth. He said that other countries such as China are already taking significant measures to dominate the crypto-space, and that the US must surpass them in order to become the global leader.

Trump also criticized the current president Joe Biden who is not running for a second term. He claimed that Biden lacked the intelligence to understand or regulate cryptocurrency. He added:

“Biden does not have the intelligence to shut it down [crypto]” Can you imagine a guy telling you that? He doesn’t know what the hell [crypto] is.”

Trump said that the crypto market was larger than many companies and countries. He stressed that now is the time to support this sector. He warned that other countries would lead the crypto market if the US failed to embrace crypto.

Trump went on to outline his plans for tackling the US debt of $35 trillion. He explained that he had been on track to tackle this issue during his former tenure, but the Covid-19 pandemic sabotaged his efforts. The billionaire has ambitious plans for leveraging crypto to strengthen the US economic system.

“But if it isn’t embraced, it will be embraced by others…other countries anyway.” But we can lead, and we should lead.”

Trump also hinted he could reduce the US debt through paying creditors in Bitcoin. This would further strengthen the case for Bitcoin to be a store value.